Despite years of struggle for equality, women in Australia still earn on average 22% less than men. This isn’t because women are all paid less for the same jobs their male counterparts hold, but there are more women in careers such as nursing and teaching; industries which workers tend to be lower paid.

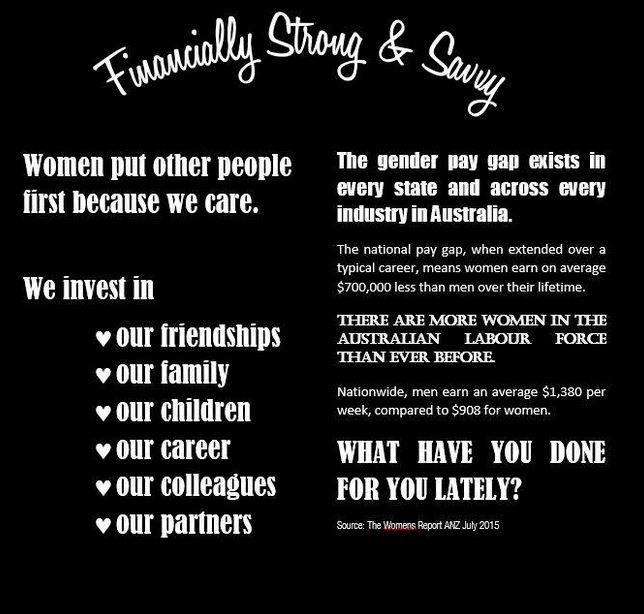

What is worrisome is the gap that opens up over a lifetime due to many women spending less time in the paid workforce than men. The ANZ Women’s Report published in July, confirms Women start the game behind, in an equivalent role, level of experience, and opportunity, many women in graduate recruitment situations suffer with less income. * It’s called ‘Gender Gap’ and is relevant in all industry. “For people aged 15-19 the pay gap is 0.3 per cent. Rising to 21.8 per cent for 34-44 year olds and 24 percent for those aged 45-54.” * That means that women aged 34-54 are on average at least one fifth worse off than their male counter parts.

A pregnant pause is real and measurable, it starts as soon as your annual leave and any maternity pay you are eligible for runs out. It has a monster hangover commonly because of a part time flexible work arrangement after maternity leave when we might be sleep deprived but we are feeling the pinch financially. So that income that you used to earn on a full time basis, has just been diluted accordingly. Most women in this category find themselves on pro-rata income meaning your income is adjusted to your time on the job (eg 2 days per week means 2/5th’s the income,2/5ths the annual leave entitlements, and 2/5th’s the superannuation being contributed for your retirement.

What about those mum-preneurs? Women who are motivated to create a business that can handle their lifestyle commitments, flexibility to work alternative hours, (yes, 11pm on Thursday night is a great time to work, no distractions) but the financial impact still leaves a footprint. The trick here is paying yourself superannuation.

Sole traders and partnerships are not required to make the same compulsory superannuation contributions as a company who contributes to super on your behalf. So every year, a failed goal to contribute to superannuation erodes your ability to retire wealthy compared with someone who is working for an employer. Compulsory super contributions commenced in 1992)

According to Sex Discrimination Commissioner, Elizabeth Broderick, this situation has dire consequences for women’s retirement savings: rather than accumulating wealth for their later years, they are “accumulating poverty”.

Does our superannuation system discriminate?

On face value, the key features of our superannuation system do not affect men and women differently. The contribution rules and limits aren’t gender biased. Nor are the various tax concessions or the way benefits are paid in retirement.

The superannuation guarantee rules require employers to contribute the same portion of staff wages into super, regardless of gender. But if we consider the above figures relating to lifetime earnings, we start to see how an indirect bias against the lower-earning average female may arise.

In addition to the superannuation guarantee, many Australian workers can boost their retirement savings significantly by making voluntary salary sacrifice contributions. Again, the higher a person’s salary and the more disposable income, the more likely the person is to take advantage of these opportunities.

Retirement savings catch up incentives

Some changes to the system have helped to restore the balance in retirement savings between men and women. Benefits that are aimed at low to middle income workers, such as the co-contribution scheme and spouse contribution offset, are particularly valuable for women who are caring for children while working part-time or not working.

The ability for a couple to share superannuation benefits upon divorce can also help to improve women’s financial independence in retirement.

But according to Commissioner Broderick, there is still a long way to go. For example, the lack of recognition of unpaid caring work in our retirement income system has been highlighted.

When making your financial plans for retirement, these non-financial factors should be taken into consideration. Otherwise you might find you, or your family, have less money in retirement than you expected. Don’t leave it too long to address this issue.

By

By