We know that we are having regular conversations with our review clients and wanted to reiterate the formal position of our investment committee to give you confidence that we are conscious of the portfolio and making considered and careful decisions. “In times like this, we know that it can feel uncomfortable as we see things playing out in the world and that volatility is really common, we can look back on past events like in the 90’s when Iraq invaded Kuwait, oil prices went crazy and markets were similar, volatility, followed by big government spending on defence, defence industries and securing water and food sources etc. “ said Tab.

There have been other geo-political events over the years like the Iraq wars September 11, and Bali Bombings and Brexit, and whilst volatility is a common theme, we do not abandon our good long term strategic decisions that support your investments.

Simon added ‘In some instances where there is a sudden drop in markets, it may even present an opportunity for someone that is investing new money.’

We are delighted to provide you with the below commentary and update directly from the Chair of the Investment committee, Emmanuel Calligeris.

Time in the market , NOT Timing the market published 25th February 2022:

Whilst I cannot understand what drives megalomaniacs and abhor war, the reality is that both exist and will continue. I remember standing in front of an audience on the day when operation Desert Storm took place and painted a fairly positive outlook about the world coming out of a severe recession in the late 1980’s. A member of the audience stood up and berated me that a war had just broken out and how could I not see that the world was falling apart. That was the 28th of February 1991 and I was only 28 years old.

Whilst I cannot understand what drives megalomaniacs and abhor war, the reality is that both exist and will continue. I remember standing in front of an audience on the day when operation Desert Storm took place and painted a fairly positive outlook about the world coming out of a severe recession in the late 1980’s. A member of the audience stood up and berated me that a war had just broken out and how could I not see that the world was falling apart. That was the 28th of February 1991 and I was only 28 years old.

Since 1991, we have seen drought, the rise of China, Y2K, the Tech bubble inflate and burst, the bond market crash in 1994, The Global Financial Crisis in 2008, natural disasters and a pandemic. Plenty to worry about that is for sure. Yet here we are today and the Australian banks still exist and lending money to people buying houses and conducting businesses, BHP, Rio and Fortescue Metals are amongst the highest dividend paying companies in Australia and we are ordering Domino’s Pizza and selling our cars through Car Sales.

As I mentioned to the member of my audience, when he woke up that morning in 1991, did he not have his cup of coffee, not brush his teeth, not buy bread and milk nor take medication because operation Desert storm broke out?

The following chart shows the return of the ASX 200 Accumulation index from May 1992 to February 2022. The accumulation index shows the growth of the market including the reinvestment of the dividends received. The return comes out at approximately 9% p.a. over that period.

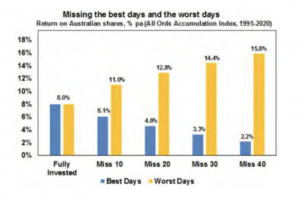

This chart shows the data of the All-Ords Accumulation Index from 1995. It has returned 8% per annum from January 1995 to December 2020. Even that equates to doubling your money approximately every 9 years.

This chart shows the data of the All-Ords Accumulation Index from 1995. It has returned 8% per annum from January 1995 to December 2020. Even that equates to doubling your money approximately every 9 years.

We are passionate about helping our clients achieve their financial goals and understand that one of the biggest obstacles in achieving appropriate investor outcomes is behaviour. Fear and greed drive us to make irrational decisions at the most inappropriate times. The chart above shows that if you missed just 40 of the best days from 1995 to 2020, you would have achieved a return of just 2.2%. versus staying put with your investments and gaining 8%. Admittedly, if you missed the 40 worst days you could have achieved a return of 15.8% however, I do not know of an investor that has been able to time the market to perfection! Hence why you may have heard the adage “its time in the market not timing the market” that gets us to our investment goals. Its times like this that its so important to remain focused on the long term and not join the rollercoaster of investor emotion that goes like this:

We are passionate about helping our clients achieve their financial goals and understand that one of the biggest obstacles in achieving appropriate investor outcomes is behaviour. Fear and greed drive us to make irrational decisions at the most inappropriate times. The chart above shows that if you missed just 40 of the best days from 1995 to 2020, you would have achieved a return of just 2.2%. versus staying put with your investments and gaining 8%. Admittedly, if you missed the 40 worst days you could have achieved a return of 15.8% however, I do not know of an investor that has been able to time the market to perfection! Hence why you may have heard the adage “its time in the market not timing the market” that gets us to our investment goals. Its times like this that its so important to remain focused on the long term and not join the rollercoaster of investor emotion that goes like this:

Prior to the invasion of the Ukraine by Russia, investors were fretting about the prospect of interest rate increases and the end of bond buying by the US Federal Reserve. We view the inevitable move towards normalisation of interest rates around major world economies is a fundamentally positive development as central banks feel sufficiently confident in the strength of economic growth and full or near full employment markets to adjust the accommodative monetary policy towards more normal parameters. The Russian invasion of the Ukraine has forced the oil price higher and increased fuel costs. This has effectively imposed a tax on consumption and may ultimately delay the rise in interest rates. This will create a period of stagnant growth with higher prices referred to as stagflation. We monitor this situation closely.

Prior to the invasion of the Ukraine by Russia, investors were fretting about the prospect of interest rate increases and the end of bond buying by the US Federal Reserve. We view the inevitable move towards normalisation of interest rates around major world economies is a fundamentally positive development as central banks feel sufficiently confident in the strength of economic growth and full or near full employment markets to adjust the accommodative monetary policy towards more normal parameters. The Russian invasion of the Ukraine has forced the oil price higher and increased fuel costs. This has effectively imposed a tax on consumption and may ultimately delay the rise in interest rates. This will create a period of stagnant growth with higher prices referred to as stagflation. We monitor this situation closely.

Markets rebounded the day of the invasion however that doesn’t suggest that resolution will be quick. The market volatility will likely continue and one trusts that the economic sanctions begin to bite sooner rather than later. In the meantime, I expect that companies will continue to invest to drive shareholder wealth and investors will reap the rewards over the appropriate time horizon. Portfolio diversification is key and the time when safer assets like bonds and gold protect on the downside.