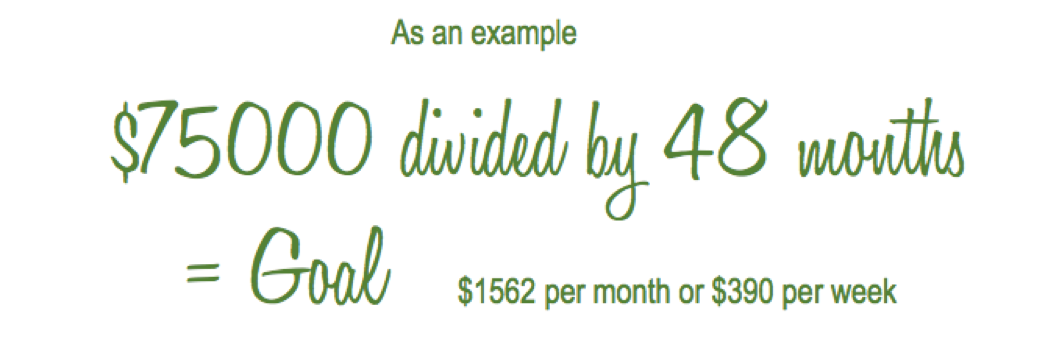

Buying your first home is such a significant milestone. Some key preparation can smooth the way. Most people setting a goal to purchase a home have considered their savings capacity and are building up a deposit. From our experience providing financial advice in Newcastle and the Hunter we have found that the goal needs to come first including a timeframe on when you would like to make your purchase. You are likely to be more successful in achieving your goal to buy a home when you have a date to aim for and a regular and achievable amount to save. Have a plan Start with the elusive ‘deposit’ that you need including an allowance for professional services like legal costs and stamp duty if any, pest and building reports. Put a number to your dream house deposit and work back from there.

You have just set a budget for your monthly savings goal with a timeframe to start looking for homes.

There are other options available when a family member is comfortable offering additional security for a loan through their own home or by going guarantor. Which professional services can help me with my purchase decision?

- Legal – Conveyancing

- Pest and Building Inspections

- Buyers Agent – to help research the property market

- Home insurance

- Lender

We have seen many property purchases happen quickly when the buyer is prepared with their team of professionals to help them at the time of negotiation. You will need to engage a conveyancer to complete the legal process for you at the time, a pest and building inspector, researching the property market and even negotiating the purchase price can be made easier if you engage a buyers’ agent to work for you. There are some great strategies to support you in your journey to buy a home, and with paying if off sooner. We recommend setting yourself up with a great overall plan including some safety provisions like personal insurance to ensure that you can afford to pay your mortgage even if something unplanned prevents you from working like an accident or illness and to ensure that you have properly documented your wishes through mechanisms like wills and powers of attorney with a legal advisor. We recommend having a real conversation about what you would want to happen if the unexpected occurred and can help you to put things in place.