An aging family member is experiencing significant health issues and needs more help than we can provide even when the load is shared between us all. What next?

I meet families often who are trying to agree on the right decision. Its emotional, often political and a highly stressful time. Its often associated with a lot of personal guilt feeling that the carer is giving in, but in reality, care needs can escalate to a level that becomes essential and not a choice.

The hardest conversations are those that have been urgent and without a lot of planning.

Through multiple years of advising clients in aged care in many differing circumstances my quick guide can be a great starting point for those that are unsure of where to start.

- Line up your ‘official’ information.

Arrange a nominee form for Centrelink to act on that person’s behalf. https://www.humanservices.gov.au/individuals/enablers/someone-deal-us-your-behalf

Understand the previously declared assets, income and any gifted monies, update the balances if needed.

Ensure that any estate planning documents are at your finger tips, Especially enduring power of attorney and enduring guardianship. If not, make an appointment to see a solicitor.

- How to gain access to care at home?

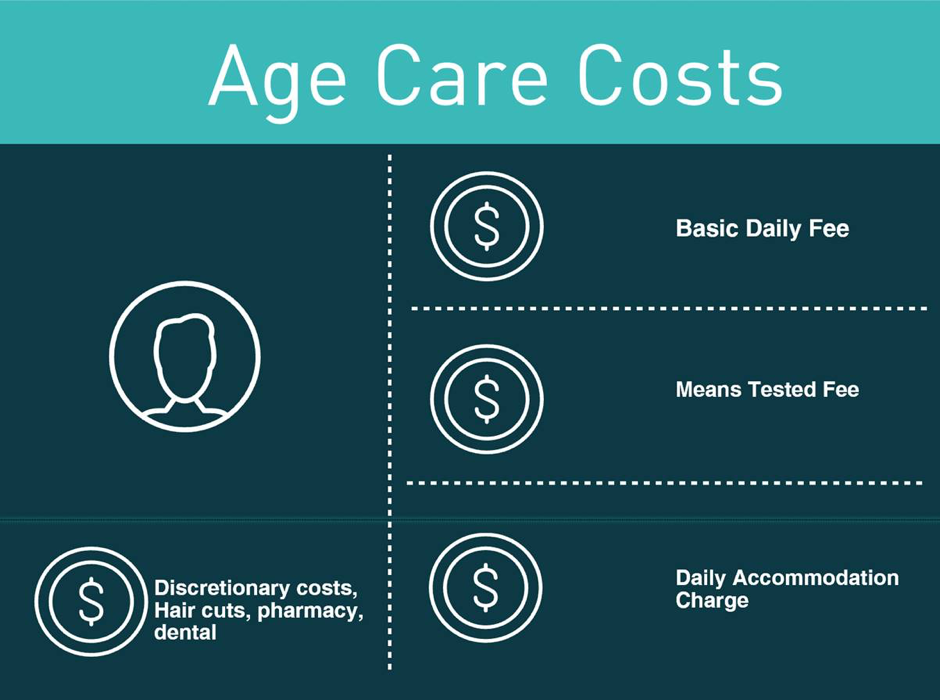

If a care facility is the right way to move forward, what should we expect to pay? And how do my assets affect the fees and the pension if they move out of their home?

The simple answer is, get some help to weigh up your options.

Care arrangements depend on your allocation/budget, the allocation is determined through a process called an ACAT assessment and can be coordinated by your GP.

Once an assessment has been offered in home, it will be determined how much care and support you can access.

An excellent tool for contacting providers about care is www.myagedcare.gov.au

- To sell or not to sell

In relation to the decision to sell the family home or not, there are a number of factors to consider;

Is there a family member that will continue to reside in the home that is in receipt of an income support payment? This person may be considered to be a protected person in which case the home will remain exempt as an asset and not income tested until that person moves out.

In any case, the value of your property can be excluded from the asset test for up to 2 years from the date of entry to the nursing home. The issue being, that after two years, you will have had to make a decision to rent it, sell it, or wear the impact on your means tested pension caused by the asset and income tests.

We put some rational decisions back into the emotional decision of accepting a move into aged care.

There are actually three different sets of calculations that can rationalise this decision.

| Pension (aged) | Fees (nursing home) | Income – from the home or other assets |

| impact to any means tested pension such as aged pension, we will consider strategies that can increase/reduce means tested pensions.

|

Calculation of aged care fees, especially the means tested fees? | Paying a lump sum towards the Refundable Accommodation Deposit (RAD)? |

Depending on your circumstances an exemption from the normal asset test may apply on a large portion of the value of your family home

- who will remain residing in the property?

- is the property is rented?

- How much refundable accommodation deposit (RAD) remains outstanding?

We provide advice to personalise the optimal decision for your loved one, so that you can understand the three interconnected issues and how they might relate if you decide to retain or sell the family home.

- Opportunity cost

The other thing to consider is the ability to invest the monies that may be available from the sale of the property in a way that could stream an income to your loved one, to assist with paying for care costs or any reduction in means tested pension.

There are lots of options in relation to investment, we can tailor a solution to your level of comfort with ups and downs or preference for stability, and can create a regular instalment of income to prop up life’s expenses or reinvest the returns if the money is only needed every so often.

In some instances, long term exemptions are permissible if a RAD does remain outstanding and the property is rented out (with actual rent paid into a bank account). Talk to us about your family, legacy intentions and together we can understand what it means for your family.

Don’t hesitate to call a family meeting and get some advice, it’s from an adviser with experience in helping families to optimise their decisions.